Q3 2025 Race Trends Report

Like-for-like events (events we have worked with for 2 years or more) achieved 5.7% growth in Q3 2025, continuing strong industry momentum.

Q3 Period: 1st July - 30th Sept

Events that have been working with Eventrac for over two years saw 5.7% growth in Q3 2025 compared to the same period last year. Whilst this is lower than the 9.2% growth we reported in Q2, it's important to note that Q3 typically includes fewer major events than the spring season, making quarter-on-quarter comparisons less direct. The 5.7% growth still represents healthy expansion and demonstrates that the industry continues to build on its strong foundations.

This report includes all mass participation sports across the UK - running, cycling, triathlon, duathlon, swimming, OCR and others.

The data reveals several key trends: younger participants (under 40) continue to gain market share, gender balance is gradually becoming more even with women slowly catching up to men, and booking patterns are becoming more consistent across different age groups. Direct bookings remain dominant at over 95%, though marketplace channels are slowly gaining ground.

Industry Trends

Age Demographics

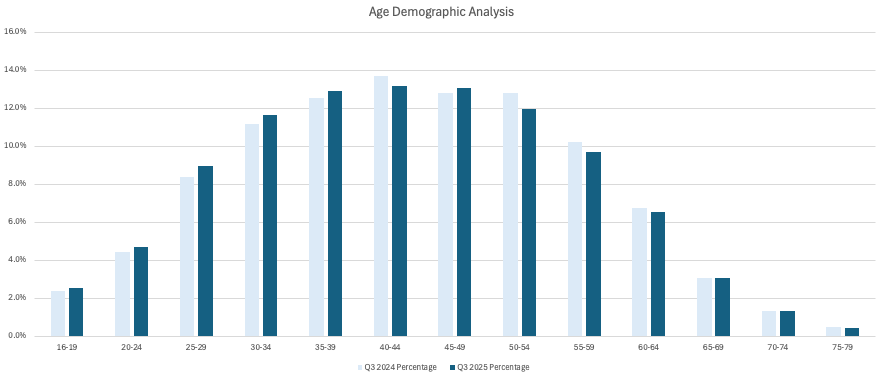

The demographic changes we've been tracking throughout the year shows no signs of slowing. Q3 2025 data reinforces the ongoing trend of younger participants increasing their interest in mass participation events.

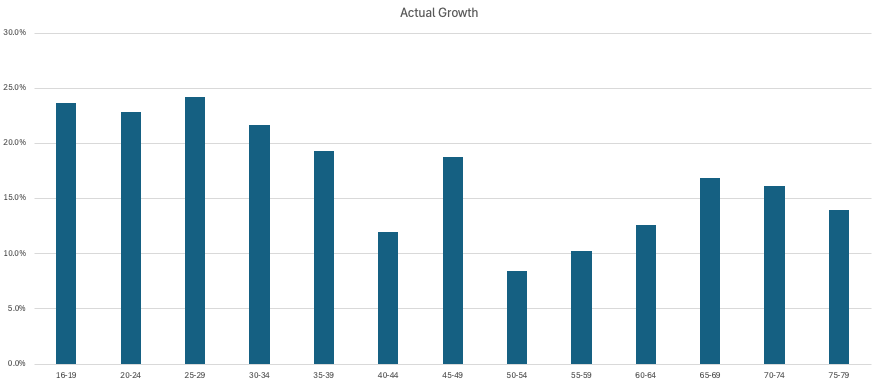

All age groups saw growth in like-for-like events in Q3 2025 v Q2 2025. Once again, the strongest growth areas came from Gen-Z and Millennials, with the 25-29 showing the largest % growth this quarter.

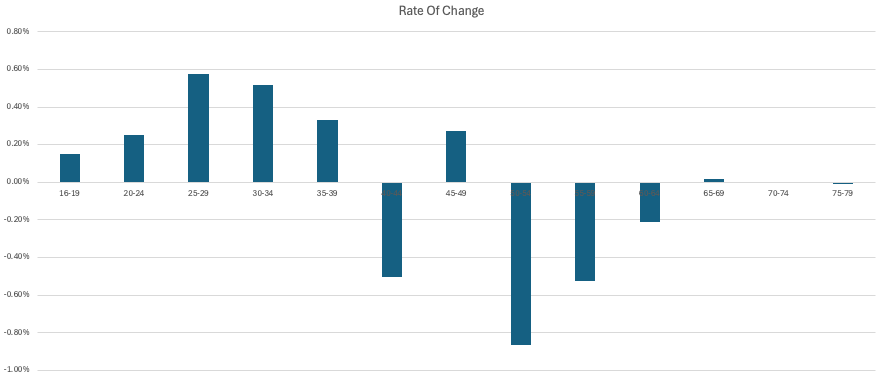

This is backed up further by the rate of change in Q3 2025 v Q4 2024, which shows how the younger generations are growing faster and gaining a larger market share over the traditionally more dominant 40+ age groups.

Note, negative here does not mean the age group is shrinking; instead, it means they are growing less quickly.

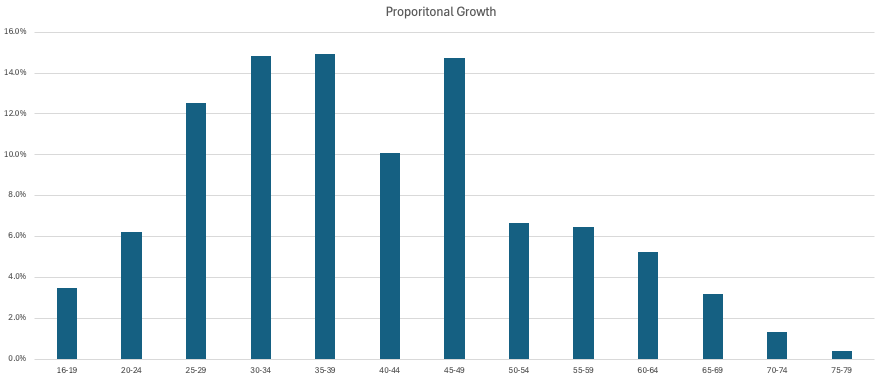

The graph below shows proportional growth i.e. each age group's contribution to total growth. Whilst the 40-49 age group saw a lower rate of change, they still represent a significant portion of the market and contributed heavily to total growth this quarter.

The overall age distribution continues to evolve. Whilst the 40-44 age bracket remains the largest single participant segment, the flattening of the age distribution curve we first identified is becoming more pronounced. The traditional peak around the 40-49 age range is gradually broadening, with younger age groups claiming an increasingly significant share of total participation.

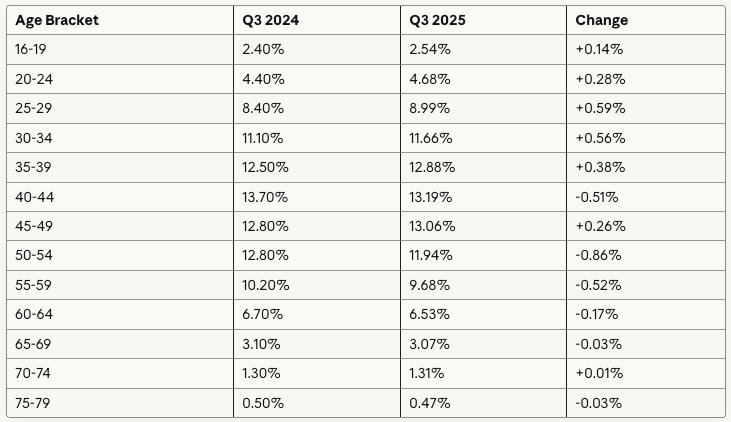

The year-on-year comparison reveals the scale of this shift. The 25-29 bracket has grown from 8.40% to 8.99% of total participation, whilst the 30-34 group has increased from 11.10% to 11.66%. Meanwhile, the 50-54 age group has reduced its share from 12.80% to 11.94%, and the 40-44 segment has slipped from 13.70% to 13.19%.

This reinforces the trends we identified earlier in 2024 - events are becoming an increasingly important part of healthy lifestyle choices across multiple generations, though the momentum remains firmly with younger demographics. Understanding whether this shift reflects changing consumer preferences, successful marketing to younger audiences, or broader demographic trends in sport participation will be crucial for future strategic planning and revenue forecasting.

Gender Analysis

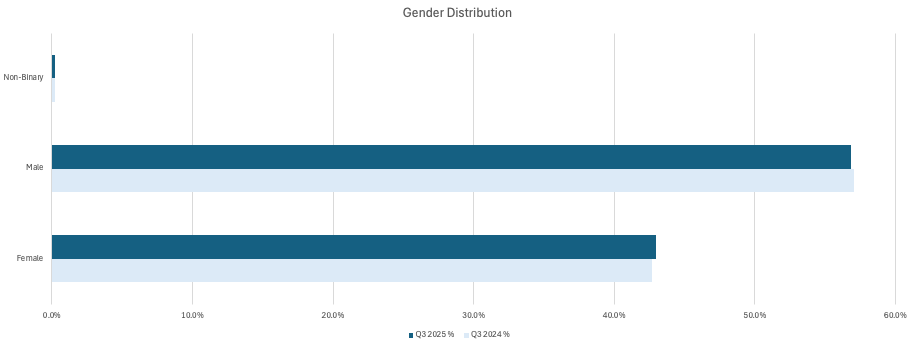

Gender distribution continues to follow the same trend, with females gaining market share. Females increased from 42.7% to 43.0% (up 0.3%), whilst males decreased from 57.1% to 56.8% (down 0.3%).

The shift is gradual but consistent - women are slowly catching up with men in attendance. Whilst the change appears modest quarter-on-quarter, this trend has been sustained throughout the year and suggests a meaningful shift in the gender composition of event participants.

Registration Timing Patterns

Advance Booking Trends

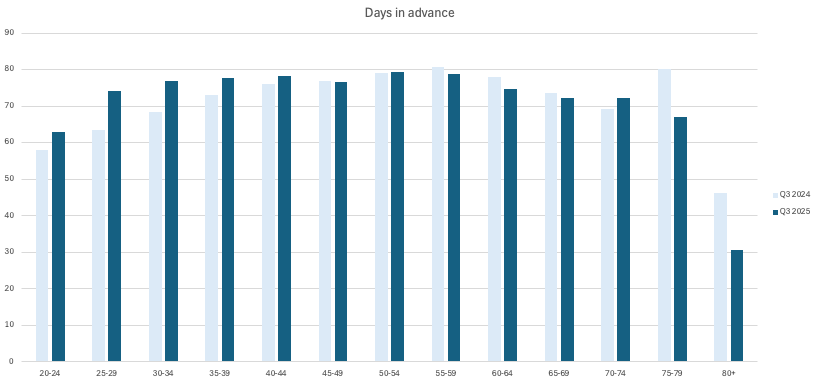

Booking behaviour in Q3 2025 remained relatively stable overall, with the average booking window holding steady at 70 days in advance, compared to 71 days in Q3 2024.

What's more notable this quarter is how consistent the booking window has become across different age groups. Most age brackets booked between 70-79 days in advance, showing a convergence in booking behaviour. Younger participants (20-39) and older participants (40-59) booked at similar timeframes during Q3, suggesting that advance booking patterns are becoming more uniform across our participant base.

This levelling out of booking windows across age groups may indicate that the tools used to encourage early entries are working effectively across different demographics.

Registration Channel Analysis

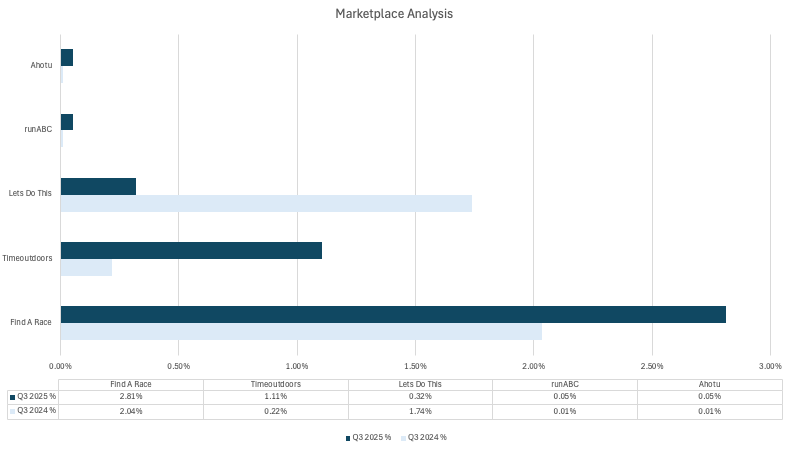

Direct bookings through organisers' own channels (websites) accounted for 95.66% of registrations in Q3 2025, representing a slight decrease from 95.99% in Q3 2024. The remaining 4.34% of registrations were processed through marketplace platforms.

Marketplace Performance

Find A Race continues to be the dominant marketplace channel, growing from 2.04% to 2.81% of total registrations. Timeoutdoors showed significant growth, increasing from 0.22% to 1.11% and establishing itself as the second-largest marketplace channel.

Conversely, Let's Do This saw a substantial decline, dropping from 1.74% to 0.32% of registrations. The newer platforms, runABC and Ahotu, remain marginal contributors with a lower number of accounts using them.

Whilst direct bookings continue to grow in absolute terms, marketplace channels are gradually gaining a larger share of the overall market. However, direct channels remain overwhelmingly dominant, representing over 95% of all registrations.

This is a good reminder of the importance of developing your own marketing strategy. Marketplace platforms take significantly higher percentage fees for generating bookings compared to direct channels, meaning that driving traffic to your own website typically delivers substantially better margins per registration.

The Outlook

Q3 2025 continues the trends we've been tracking in our year-end report and earlier quarterly updates. The industry remains in good health, with like-for-like events growing by 5.7%, demonstrating that established events are successfully growing their participant numbers year-on-year.

Growth is happening across all age groups, but particularly among Gen-Z and Millennials. The shift towards younger participants that we've been monitoring throughout the year is still going strong, with the under-40s taking up a bigger share of the market each quarter.

The data shows that the industry is successfully attracting new types of participants whilst keeping its core base engaged and growing. The consistent like-for-like growth demonstrates that existing events are building on their success and expanding their reach.

As we move into Q4, it will be interesting to see whether this momentum continues through the traditionally quieter autumn and winter months, and whether younger demographics will keep expanding their share of total participation.